UK finance decision-makers are unlikely to change their accounting software, even if they could achieve a return on investment within the next 12 months.

There are many factors for financial decision-makers to consider when changing their accounting software, such as industry-specific functionality, cloud or on-premise, scalability, as well as security and useability – all are important elements to think about when establishing your digital finance transformation action plan.

There are many factors for financial decision-makers to consider when changing their accounting software, such as industry-specific functionality, cloud or on-premise, scalability, as well as security and useability – all are important elements to think about when establishing your digital finance transformation action plan.

This was a key takeaway from our new research which reveals that over a quarter of UK finance decision-makers would be unlikely to change their accounting software, even if they could demonstrate a return on investment within the next 12 months.

What does this mean for digital finance transformation?

We sought the opinion of 1,000 UK-based finance decision-makers working in organisations that employ between 50 and 500 employees and found that the legacy accounting software that many businesses are tied into, even when migrated to the cloud, fails to provide the flexibility required by today’s businesses.

Even more galling for mid-sized companies is that many smaller businesses that can get away with using an entry-level solution can enjoy the benefits of true cloud software, albeit without the full set of features they need as they grow.

Investigating how finance decision-makers plan, manage, and deliver the finance function in their business – we specifically looked at the perceived barriers to changing accounting software, digital finance transformation, current processes and future priorities.

Creating a coherent digital finance transformation plan is one of the key success factors when looking at changing accounting software.

Running a modern finance function involves much more than ensuring smooth month-end processes. Finance decision-makers need to carefully weigh up the pros of changing to a true cloud accounting software, vs the cons of sticking with an incumbent – which may lead to a realisation that there is actually nothing to fear about changing providers.

From the ability to upload expenses to drilling down through reports, to gain access to specific information – extending the accounting solution outside finance is a fundamental step to improve insight, control and timely decision-making, all the while reducing the burden on the core finance team. Staff development and retention are essential to your business, yet using outdated software and processes can cause staff to think of leaving.

Breaking down the barriers

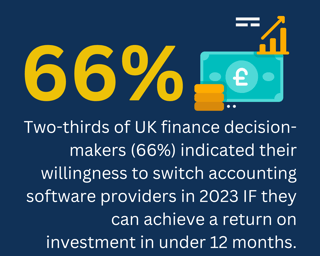

Encouragingly, however, two-thirds of UK finance decision-makers (66%) indicated their willingness to switch accounting software providers in 2023 IF they can achieve a return on investment in under 12 months.

Whilst in part these results offer reassurance that there is an appetite from UK finance decision-makers to take proactive steps and secure the best accounting software, it also highlights a fear about what changing accounting software providers actually involves.

A fear which we feel is misplaced.

The industry needs to do more to support finance leaders in transitioning from out-of-date software. When finance leaders feel supported by their peers and are able to visualise the benefits, the change process will be much smoother.

Earlier results released from the research revealed the top three reasons why UK finance decision-makers are hesitant to change accounting systems are losing historical data (14%), the cost of having to pay for a Right To Use (RTU) licence in order to access historical data (12%) and being too expensive (11%).

The good news? Changing accounting software does not have to be scary!

Using the correct finance accounting software technology will improve operations, generate savings and support staff and customers alike – while positively impacting the bottom line for bold digital finance professionals willing to make a change.

The full results of the independent market research are available to view in our report, titled: ‘A study 1,000 CFOs - the finance function and the limitations of current accounting systems'.

To find out more, and to book a call for your organisation, select the “Book a Demo” button on the homepage.